If we talk about cryptocurrencies and Blockchain technology then there are different stands of different countries for crypto in the world. Some countries are in favour of cryptocurrencies and some are finding a way to ban them.

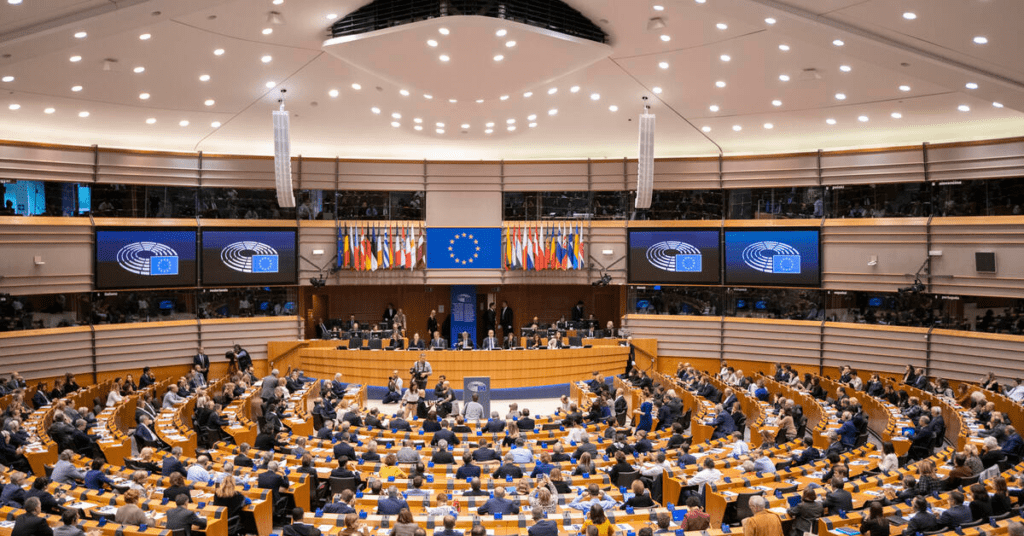

Today news was published on The Block website, about the voting in favour of using Blockchain technology to modernize tax by European Union (EU) Policymakers.

According to this report, European Parliament voted in the favour of a resolution that acts as a crypto-focused double whammy. This resolution will focus on tax evasion through crypto assets and will create rules for crypto taxation.

This EU resolution will try to identify the taxable events related to crypto and the most viable option will be the conversion of crypto to fiats. But there is not much clarity about this resolution and the EU has not clarified it yet and considering the crypto’s borderless nature.

According to this regulation, the exchange of taxpayer information by cross-national tax administration will need to include information on crypto-assets. This policy also includes a simplified and easy tax treatment for smaller crypto transactions.

This regulation also shows that Blockchain technology has pushed forward tax management and collection which means it has the potential to automate tax collection. This regulation also prevents corruption and easily identifies the ownership of tangible and intangible assets to improve the tax system for digital taxpayers.

This regulation also encourages European Union member states to reform their taxation authorities and implement blockchain technology in the taxation system.

The resolution’s file is passed in the Parliament’s plenary session with a majority of votes, 566 votes in favour and 7 votes against it whereas 47 abstentions.

I am Pawan Kashyap currently living in Amritsar. I always try to grab new things from the cryptocurrency market. From my observations and trends in the market, I always try to provide the best and accurate information in the form of articles from this blog. Follow us on Facebook, Instagram, and Twitter to join us.