In the cryptocurrency market, there are many coins and tokens where people invest to earn returns from their investments. Investors use strategies like buying and selling, HODL, staking, etc. to make huge returns. But do you know there is another method called Crypto Arbitrage to earn short-term profits?

If you haven’t heard about Crypto arbitrage then don’t worry in this article you will learn what is Crypto arbitrage and how to make profits from this technique. So keep reading this post.

What is Crypto Arbitrage?

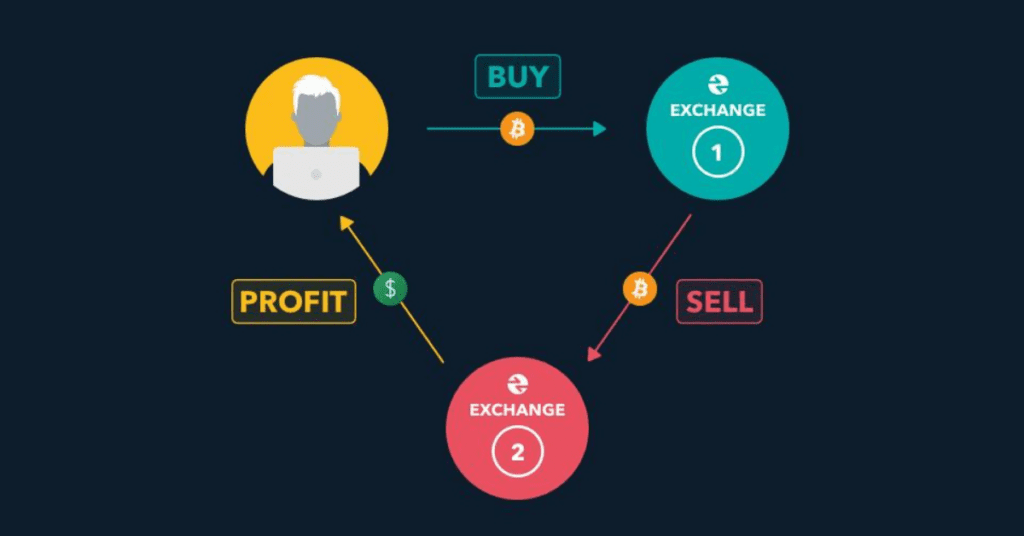

Crypto arbitrage is a term where investors buy a cryptocurrency from one exchange and quickly sell it on another exchange at higher prices. Let’s explain this in detail, there are many cryptocurrency exchanges in the world like Binance, Coinbase, Gemini, WazirX, Zebpay, Bitbns, etc. You may see some price differences for the same cryptocurrency on all these exchanges.

Now the idea behind Crypto Arbitrage is to find and buy a cryptocurrency with the lowest price on any exchanges and then sell it at a higher price on another exchange. That’s it the difference between the prices is your profit.

How Does Cryptocurrency Arbitrage work?

In Cryptocurrency Arbitrage you have to choose some cryptocurrency exchanges where the prices of the same coin or token are different. Then you have to create an account on that crypto exchange to buy and sell your coin or tokens.

Steps To Do Crypto Arbitrage:

- Find and select the crypto exchanges with the lowest cryptocurrency prices.

- Shortlist the coins you want to use for cryptocurrency arbitrage. At the same time, select the coin you also need to check the transfer fees on that token.

- Then buy that token with your suitable amount.

- After successful buying transfer the tokens or coins to another exchange where the prices are higher.

- Now sell them there to book your profit. That’s it.

What Are Types of Crypto Arbitrage?

There are some different types of Crypto Arbitrage according to the ways the investors use it.

1. Spatial Arbitrage: Spatial Arbitrage is a type of cryptocurrency arbitrage where investors trade virtual currencies across two different exchanges. This is a simple tactic of crypto arbitrage where traders can take advantage of price discrepancies between two exchanges. There may be a risk of transfer time and costs in this tactic.

2. Spatial Arbitrage Without Transferring: This is another type of crypto arbitrage where traders need not take the risk of transfer costs and time that spatial arbitrage poses. For example, a trader may go long on Bitcoin on one exchange and short on another, and wait until the prices on both exchanges converge.

In this case, they need not transfer the coins among exchanges, but they still need to deal with trading fees.

3. Triangular Arbitrage: In Triangular Arbitrage, the traders take advantage of price inefficiencies among different pairs of cryptocurrencies on the same crypto exchange. Sometimes you may see price inefficiencies among different pairs of cryptocurrencies on the same exchange. Then you can buy one cryptocurrency and then trade it with another on the same exchange one with undervalued relative to the first crypto. Then trade that second cryptocurrency for a third cryptocurrency which is relatively overvalued when compared with the first. At last, you need to trade that third cryptocurrency for the first cryptocurrency to complete the circuit to gain some profit.

How to Find a Crypto Arbitrage?

While doing Crypto Arbitrage you need to remember that not every cryptocurrency is suitable for arbitrage. You must find some cryptocurrencies to find arbitrage opportunities. Here are two different methods to find crypto arbitrage opportunities.

1. Using Cryptocurrency Arbitrage Software: Finding the perfect cryptocurrency to arbitrage may be a daunting task for you. That’s why some companies have developed cryptocurrency arbitrage software to track hundreds of cryptocurrency exchanges in real-time to find arbitrage opportunities.

KoinKnight is one of some famous cryptocurrency arbitrage platforms where you can track hundreds of cryptocurrencies on different platforms to find some arbitrage opportunities. KoinKnight also provides the analysis of historical cryptocurrency arbitrage data to help you refine your cryptocurrency arbitrage strategies and plan two-step ahead even before the original arbitrage occurs.

2. Using Less Popular Cryptocurrencies: Traders can also find bigger price differences for the same cryptocurrencies among less-popular and less frequently traded forms of crypto. Less popular cryptocurrencies are prone to rapid price changes. That can be good or bad for the trader, there may be a risk to an arbitrage strategy.

I am Pawan Kashyap currently living in Amritsar. I always try to grab new things from the cryptocurrency market. From my observations and trends in the market, I always try to provide the best and accurate information in the form of articles from this blog. Follow us on Facebook, Instagram, and Twitter to join us.